How to Build Credit Fast?

Boost Your Credit Score

Boost Your Credit ScoreBoost Your Credit Score

Boost Your Credit Score

The path to a good credit score can be long and winding, but the rewards are worth it. It takes time for your finances to recover from bad credit as well - if you're trying to build up those scores again then remember that this process may take some discipline too!

Maintaining excellent standing in regards to financial responsibility isn't just about keeping track of bills or paying them late- it's also ensuring all available opportunities have been explored so there won’t ever be another emergency expense coming out of pocket like an unplanned major blending cycle did last year which put me under.

You can’t afford to trust any credit repair agency that says they have a secret formula for raising your scores quickly. While some may promise this, there's no evidence it actually works and will only waste more of your time if you try nothing else too!

Earning your way to better credit is possible with some healthy habits.

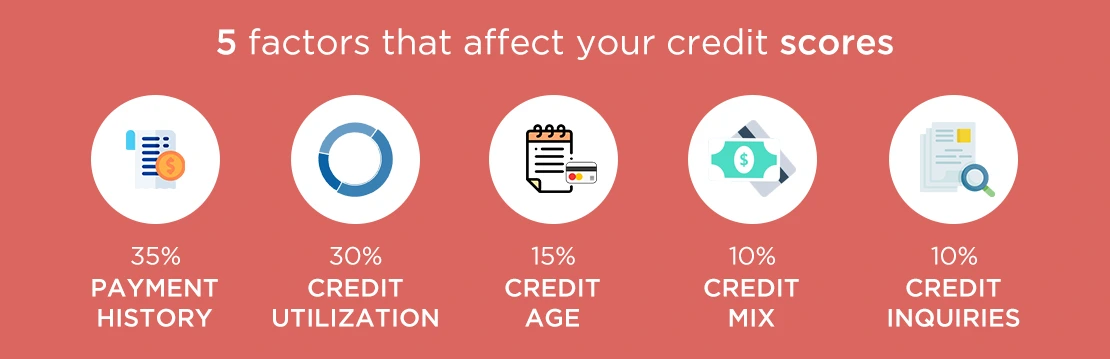

Credit scores are a way for lenders to determine your financial responsibility. There's more than just how much you earn and spend, so it pays off in the long run when making decisions about borrowing money or securing other types of loans such as mortgages!

1. With payment history as the most important part of your credit score, it’s crucial to make every effort possible for on-time payments each month. If you are ever late with a payment even just one day can haunt you seven years from now!

2. You may have heard of credit ratings, but what about your finances? This is the measure of how well you use all available channels to manage purchases. Experts recommend keeping it below 30%—and preferably much lower!

3. The length of your credit history has a lot more impact than you might think! This factors in the ages and types (or absence) on all accounts, as well as how old these different pieces are. The older an account is - say compared to another with less activity- it shows lenders that we're responsible individuals who can be trusted not just now but into the future too.

4. It's important to maintain a good credit mix. This means balancing revolving accounts like credit cards with installment ones such as mortgages, student loans, etc. so that you're not too heavily relying on any one type of account for stability in your financial life! Maintaining an optimal balance ensures greater risk-adjusted returns when borrowing money there is another way we can help our customers get ahead!

5. What you do with your credit has a lot to do with how it works. Your recent history also influences what kind of loans and cards offer the best rates for new consumers, so make sure this is in line with where things are going!

To get your credit score up, you need to create some consistent habits. One of the most impactful things that can be done for a person with bad or no credit is creating these tips into their lifestyle and then watching as it improves everything from loan applications all along the line!

Your credit score is important, and it can make or break your plans. That's why we want to help you keep an eye on the accuracy of any information from the major consumer bureaus like Experian, TransUnion, and Equifax. If there are errors in this report when checking out how much debtors owe according to their reports then don't hesitate - to contact us right away so that our experts may file disputes if needed!

The importance of keeping an eye on your credit cannot be overstated. You should sign up for any type and amount of credit monitoring services that are available to stay ahead with the game, as it were! If you detect anything suspicious going down regarding accounts such as unauthorized use or fraudulent activities then report them immediately so they can get removed from reports before bringing down good scores even further than what has already happened thus far.

You've got a lot of credit card bills to pay off, and it can be tough figuring out the best way. The snowball method focuses on paying down the lowest balances first while avalanche schemes give priority to those with the highest interest rates but both these approaches have limitations if you have too many cards or not enough money in one place for monthly payments because then they won't go away quickly enough! There is also something called "the Richards fix" which helps boost your score by consolidating all debt onto one low-interest rate consolidation loan - though this may take some time before considering as well...

Missing a single payment can have devastating consequences for your credit score. But if you're able to make all of the payments on time, it will help protect and solidify that history over time-which might be enough in itself!

Try to make smaller payments every two weeks instead of one big payment at the end. This could help you sneak in more interest-free days and save money on top of things like fees, compounding effects (which improve your scores), as well as lower credit balances which can raise them even higher!

If you're struggling with making your monthly payment, lowering the interest rate on a loan could help. When more of each repayment goes towards principal rather than fees or other costs associated with borrowing money - like credit utilization ratio (which measures how much debtors are using) - it can lead to higher scores and less stress overall!

7. Ask for a credit limit increase

A higher credit limit is another way to help reduce your credit utilization ratio, which can help raise your credit scores. Keep in mind though that some credit issuers do a hard credit check when you request a credit limit increase, and that can cause your credit to dip.

8. Mix it up

Your credit mix is the key to a higher score. It's what lenders look at when deciding how successful you'll be in borrowing money, and it helps if your report has plenty of revolving accounts as well as installments like mortgages or auto loans! The more diverse types of debt available for consideration by potential creditors means better prospects - so don't take out an unnecessary loan just because this one type sticks out from others already present there.

9. Become an authorized user on someone else’s account

When you’re new to credit and can't qualify for your card, becoming an authorized user on someone else's account can be a great way to start building up that stellar history. But it comes with some risks: if the person who owns said accounts have healthy borrowing power then using them as collateral might help establish good ratings in future months/years but missing payments or carrying high balances from previous years could also reflect poorly upon us – so make sure it's worth taking this step based off what kind trustworthy friend (or family member) we pick!

Hire credit Repair Ease for Build Credit Fast

Want to quickly increase your credit? Take into consideration working with Credit Repair Ease, a reputable credit repair business committed to effectively assisting you in raising your credit score. With customized tactics catered to your particular financial circumstances, Credit Repair Ease guarantees focused solutions for expunging errors and unfavorable things from your credit report. Their team of professionals puts in a lot of effort to contest mistakes, bargain with creditors, and offer continuous assistance all along the way. By utilizing Credit Repair Ease, you may obtain expert guidance and tried-and-true methods for rapidly and efficiently improving your creditworthiness, opening up new financial avenues, and bringing you peace of mind.

What are the quickest ways to build credit?

Paying bills on time and reducing credit card balances are quick ways to build credit.

Can becoming an authorized user improve my credit fast?

Yes, being added to a card with a good payment history can quickly boost your score.

How does a secured credit card help?

Using a secured credit card responsibly can build credit fast by showing good credit behavior.

Why is reducing credit card debt important?

Lowering your credit utilization ratio can quickly improve your credit score.

Can disputing errors on my credit report help?

Yes, correcting errors can lead to a rapid increase in your credit score.