The credit utilization ratio is the essential factor in determining your credit score. If you have a high balance-to-credit limit ratio, getting approved for a new loan or line of credit can be challenging because lenders see you as risky and potentially unable to pay back their money. Luckily, improving your credit utilization ratio is easy!

Credit utilization is the total credit card balance ratio to your available credit limit. This number helps lenders understand how much of your available line you're using, and it's a critical factor in determining what interest rate they'll charge you. Keeping a low balance on your cards will help you maintain a good Credit Score.

A credit score is a numerical representation of the information in your personal financial history. It's calculated from your spending habits and ranges anywhere from 300 to 850-- though if you're over 18 years old with no criminal record, anything under 650 should be enough for lenders to approve loans or mortgages.

A credit score can range between 300-850 points - but it doesn't matter how high that number may get. According to a law passed by Congress back in 2003 (the Fair Credit Reporting Act), nobody has access to see who gets what when they go shopping around for financing deals at their local lender.

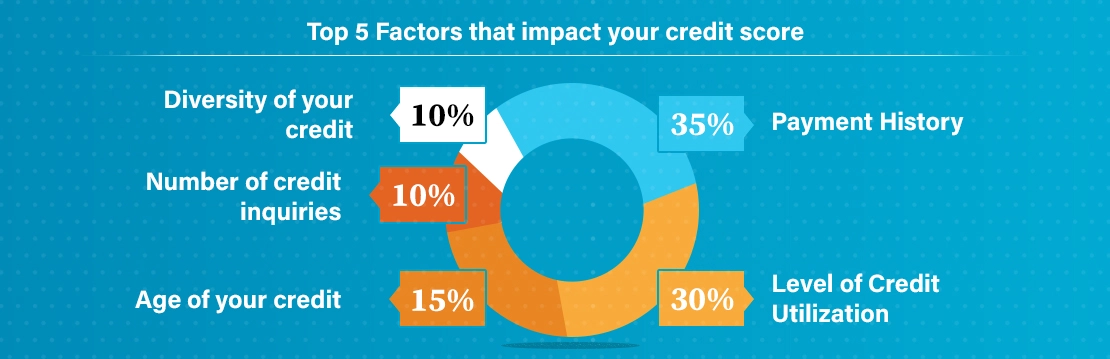

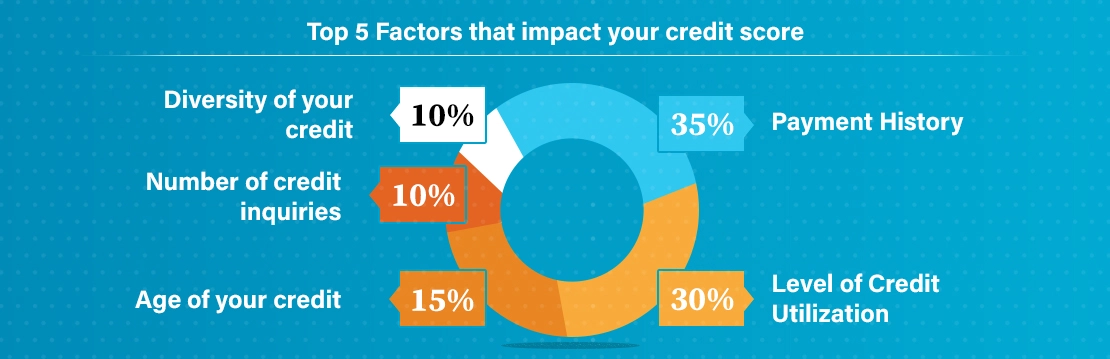

Payment history (35 percent)

Level of Credit Utilization (30 percent)

Age of your credit (15 percent)

Diversity of your credit (10 percent)

Number of credit inquiries (10 percent)

Your credit utilization ratio is the amount of debt on your credit card divided by the total limit on that card. To calculate this, divide the balance on your account by the limit. For example, if you have $10,000 in debt and a limit of $25,000, then your credit utilization ratio would be 40%. That means that 40% of all available lines are used for purchases or cash advances. The lower this percentage goes down to under 10%, the better! However, anything over 30% will affect how well you can borrow money in future, as lenders see this as an indication that you're struggling financially with managing your credit.

Below is an example of how a credit utilization ratio is calculated. Say a borrower has three credit cards with different revolving credit limits.

Card 1: Credit line $5,000, balance $1,000

Card 2: Credit line $10,000, balance $2,500

Card 3: Credit line $8,000, balance $4,000

The total revolving credit across all three cards is $5,000 + $10,000 + $8,000 = $23,000. The total credit used is $1,000 + $2,500 + $4,000 = $7,500. Therefore, the credit utilization ratio is $7,500 divided by $23,000, or 32.6%.

The credit card utilization rate is the percent of a credit card's available credit that is used in a given month. The higher credit card utilization ratio, the more likely it is that the card will be declined.

Credit cards are an easy way to get money when you need it, but they can also be costly if they are not used wisely. One way to avoid this is by keeping track of how much money you spend on your credit card each month and looking for ways to reduce those expenses.

The average US household has $7,000 worth of debt and nearly half of Americans carry at least one credit card. Credit cards provide a convenient way to borrow money and pay it back later with interest, but they also come with risks like high interest rates and possible bankruptcy if not used responsibly.

A good credit card utilization ratio is typically less than 30%. That means you should never use more than one-third of your available credit on any given month. Utilizing too much of your available credit can negatively affect your score, so keeping this ratio as low as possible is essential.

A high credit utilization ratio can also lead to increasing interest rates and late fees from lenders. Keeping a lower balance on your account will help you maintain a healthy score, avoid penalties, and save money in the long run.

Credit utilization is the ratio of your debt to your credit limit. It can also be interpreted as how much of your available credit you are using at a given time, which can affect your score and the interest rates and fees associated with any new or existing loans. Typically, someone with a high credit utilization rate will have a lower score because it indicates they're taking on more debt than their income allows. But there are ways to improve this situation.

Paying down debt is the most critical step you can take to help your credit score. To do so, make sure that every month on each of your credit cards, you're paying more than just the minimum amount due; in some cases, they may require a certain percentage like 10% and if not possible, then at least pay 100%. It would help if you also considered consolidating all those pesky balances onto one card with an introductory 0% APR balance transfer offer (make sure this doesn't go over 30 months, though).

Pay off high-interest debt first - Paying down debt with the highest interest rates, such as purchases and cash advances from credit cards. It can help lower what you owe faster by reducing monthly payments on those accounts while boosting your FICO® rating for paying higher balances each month. Ensure that any additional money going towards finances goes directly into long-term investments like compound savings bonds, which earn interest at about double what most loans offer today (and are exempt from income tax).

You may be tempted to spend money that you don't have, but if you can resist the temptation and use your credit card wisely, getting a credit limit increase will improve your ratio. You'll get an automatic hard inquiry which temporarily drops your score by 5-10 points, but this is all worth it because, in the end. With just one extra bump of up to $15k on maximum spending allowance as opposed to only 8k before, there's less chance of maxing out past the 25% utilization rate for every dollar spent now.

Keeping an account open can be a wise move for several reasons. First, you may want to keep it in your wallet as a form of security against getting into debt again and then having no way to pay the bills or other necessities like groceries. Second, suppose you close out the account that has been paid off but still bear interest on outstanding balances (credit cards typically charge between 12% and 17%). In that case, this will negatively impact your credit utilization ratio, which could significantly affect your score and the rates others offer when lending money, such as mortgages or car loans.

Credit utilization is a factor in your credit score. One way is with balance alerts, which notify you when it reaches a certain percentage. Set up a monthly alert and stay informed about how much money goes through your card each month- giving yourself peace of mind and improving your score.

If you have any questions about the credit utilization ratio, call the credit specialists at CreditRepairEase at (888) 803-7889. For more than 7+ years, CreditRepairEase has helped clients work towards fair and accurate credit scores by leveraging their rights.

To calculate your credit card usage percentage (also known as credit utilization), use this formula:

Credit Card Usage Percentage = (Current Balance / Credit Limit) × 100

Find your current balance: This is the amount you're currently owing on your credit card.

Find your credit limit: This is the maximum amount your credit card issuer allows you to borrow.

Plug the values into the formula: Divide your current balance by your credit limit, then multiply by 100 to get the percentage.

Current balance: $500

Credit limit: $2,000

Credit Card Usage Percentage = ($500 / $2,000) × 100 = 25%

This means you're using 25% of your available credit. It's generally recommended to keep your credit utilization below 30% to maintain a healthy credit score.

Credit utilization ratio is the ratio of credit card limit to the amount of debt that has been used.

A good credit utilization ratio is between 50% and 90%.

Most credit experts advise keeping your credit utilization below 30 percent, especially if you want to maintain a good credit score.

Upto 30% to 35% percentage credit card utilization ratio is considered as good.