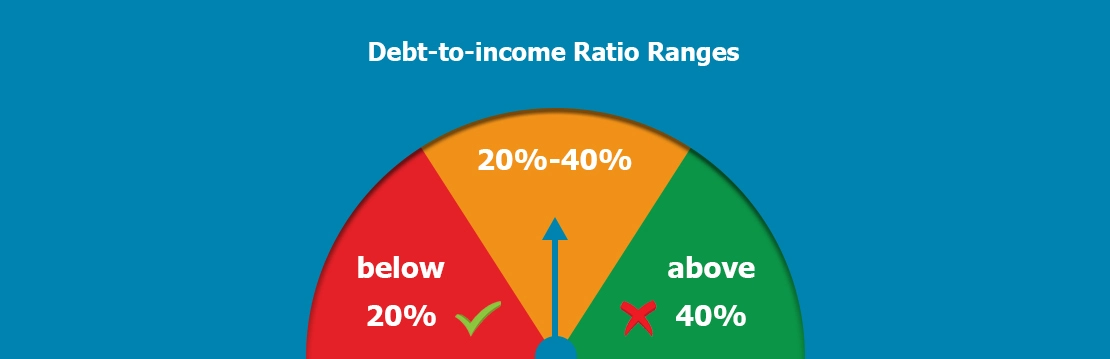

Let's say that you have $10,000 in credit card debt and make $3,000 a month. Your debt-to-income ratio would be 30%--too high for the banking industry. There are many ways to improve this ratio. For example, you could pay off your credit card debt with an emergency fund or try applying for a new loan with better terms!

1. Increase your income:

The best way to increase your income without too much work is by finding a side hustle based on one of your hobbies. For example, if you love to cook and take pictures then start a food blog with photos for recipes. You'll be able to post content regularly instead of putting in more time at the office which will give you more free time while making money!

Pay off high-interest debt first - Paying down debt with the highest interest rates, such as purchases and cash advances from credit cards, can help lower what you owe faster by reducing monthly payments on those accounts while boosting your FICO® rating for paying higher balances each month. To pay more than just the minimum payment due every month, make sure that any additional money going towards finances goes directly into long term investments like compound savings bonds which earn interest at about double of what most loans offer today (and are exempt from income tax).

2. Pay off your debt:

If you have debt, the best way to get out of it is to pay off your debts. If you are struggling with high interest rates on student loans or credit card bills, consider using a balance transfer offer that will help save money and stay in control of your finances. With more than 25 years of experience in the financial industry, we at Balance Credit Union can help make any situation better for our members by offering them competitive rates and excellent customer service.

If you have any question about the Debt to Income Ratio, give the credit repair experts at CreditRepairEase a call on (888) 803-7889. For more than 7+ years, CreditRepairEase has helped clients work towards fair and accurate credit scores by leveraging their rights.