What is CPN Number ?

A credit privacy number is a nine-digit identifying number similar to Social Security. Companies offer them to consumers with bad or no credit instead of using their Social Security numbers on applications for loans and other forms of financing. Still, some experts say it can be difficult if you want any banking services at all because certain restrictions are placed around who has access to your CPNs information when they're used this way - including law enforcement agencies!

What are CPNs used for?

Credit privacy numbers(CPN) are fraudulent credit options that can be used in place of Social Security numbers when applying for loans. These reassignment scamming schemes promise a way to open up new lines with low scores or even just one without being held back by older, less desirable data from the company that runs your records! That is why these CPNs might seem tempting at first - despite being illegal- but you must understand what kind of risk comes with them too because they will always come down hard on those caught using forged documents."

Unfortunately, people are still getting scammed out of their hard-earned money. This time, it is through a credit privacy number scam that works because there are loopholes in both Social Security Administration databases and reporting agencies for banks. Get away with fraudulent transactions using fake SSNs without being caught by either party due to a lack of screening or scrutiny at all levels since they match up names!

How CPNs are Created

Credit privacy numbers are a scam! You might think the Social Security Administration creates them, but this isn't true. Scam artists promise these credit numbers to add a layer of security in exchange for money. But it'll cost you more than just your bank account because identity theft occurs when someone uses another person's documents without permission to get loans or apply for other services like car rentals that require verification with government databases (not including social).

Synthetic Identity Fraud

Credit privacy numbers created with synthetic identity fraud are the leading form of credit card theft in America and account for 80 percent of all losses. Credit cardholders can be at risk if they use an algorithm to create their own Social Security number, which will then have their digits checked against one that's already been issued or released by US authorities (this often happens overseas).

Identity Theft

Identity theft is a severe problem in the United States. Can Credit card numbers and other personal information be used to open new accounts, but what about when someone has been wrongfully accused of identity fraud? There are ways for them to get back on track with their life after being falsely branded as an ID thief!

Are CPNs Illegal?

Credit privacy numbers are not something that I should give out because they're illegal. They originated from the legal grey area of the Privacy Act 1974, which gave individuals their right to withhold social security numbers when other federal laws require it. However, this law doesn't make them legal or any less prone to identity theft-theft can still land you in hefty penalties and jail time!

Credit card numbers are becoming more and more valuable as hackers find new ways to use them. A significant part of this threat comes from synthetic ID fraud. Including credit privacy number theft, among other things like scamming an account through fake e-mails or phone calls pretending you have committed some crime so they can get your info before asking for payment upfront fees at sites.

How to Avoid Credit Privacy Number Scams

One of the most prevalent forms of identity theft is credit card fraud. It occurs when someone steals your credit card number and uses it to make purchases.

The first thing you can do to avoid this is to choose a good password for your credit card account that you don't use anywhere else. You should also keep an eye on your bank and credit card statements and report any suspicious activity immediately.

The only way to truly protect your personal information is by understanding that no matter what company or business you are dealing with, there will always be a potential for data theft. So before giving out any sensitive details, ensure they have an official-looking website and call their numbers carefully!

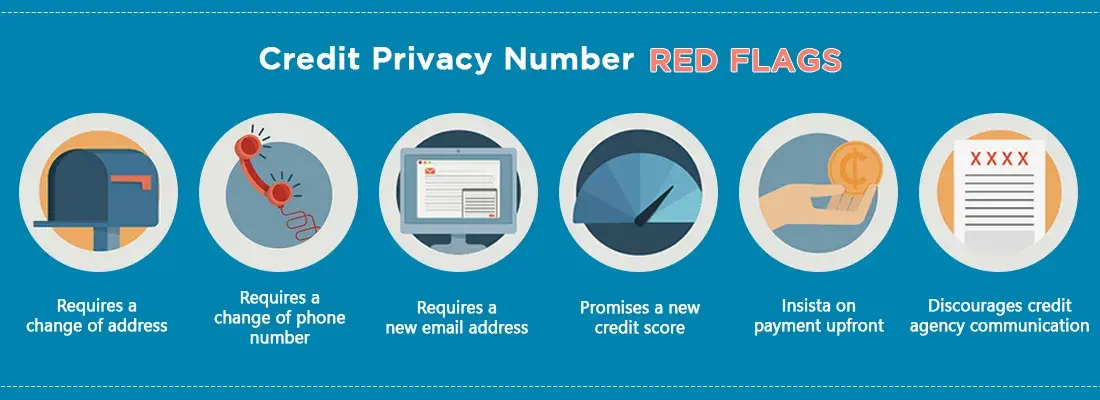

Scam red flags

• Requires a change of address

• Requires a change of phone number

• Requires a new email address

• Promises a new good credit score

• Insists on payment upfront

• Discourages credit agency comminication

Reporting Credit Privacy Number Scams

Identity thieves are constantly trying new ways to steal your identity and commit fraud. If you run into a credit privacy number scam, some simple steps can help stop it from happening again:

You should contact law enforcement immediately by filing an official report with the offices of the State’s Attorney General and contacting Federal Trade Commission (FTC) directly through their website for more information on how they handle these cases and reporting any other businesses practicing illegal scams, including those involving personal data such as social security numbers etc.

The right way to repair your credit

Instead of turning to illegal credit repair scams, there are many avenues for legally repairing your score. Our guide on raising high-impact and sustainable ways includes fixing errors with accurate information so you can get the best possible result in no time!

Additionally, sometimes just getting others aware of what's happening is all that's needed to improve someone else's financial health. And this article also covers some great tips like using services like Credit Repair Ease, which offer affordable rates without any hidden fees or annual commitments (pay when it's bill).

Call on (888) 803-7889 to know more about your credit score now!