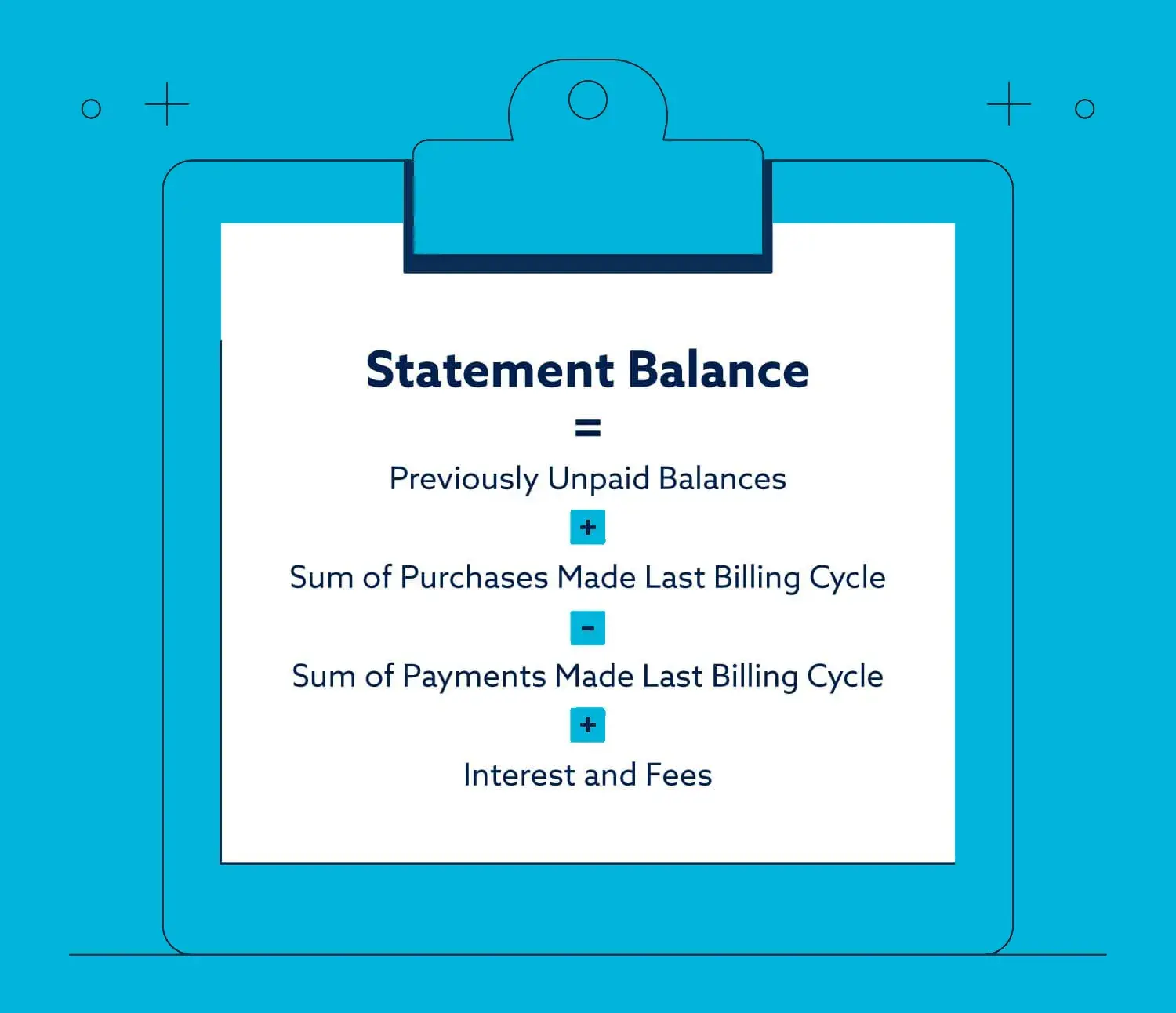

How is my statement balance calculated?

Your credit card statement balance reflects all of the purchases and payments you made last billing cycle plus any previously unpaid balances. It's generated on a special day just for this purpose - also called 'closing day'.

Your billing cycle is the number of days in which your monthly statement covers. On this timeline, you can find a start and end date for each period that will determine when payments are due on any future invoices or bills from us!

By understanding your billing cycle, you can make sure that each transaction falls under the proper date. For example if a payment is due on Monday and Tuesday but it was made Wednesday then they will both fall into Wednesday's category instead of Friday which would have been what happened without knowing this information first!