Credit repair specialists are dedicated to helping consumers overcome the barriers that prevent them from achieving their financial goals. The most important aspect of credit repair is building a relationship with our clients and understanding what they want to accomplish to provide them with personalized guidance on how we can help. They will work to remove any negative marks on a person's record, as well as assist with rebuilding their score by establishing new lines of credit or paying off old debts. Credit repair specialists are often hired for individuals who have been turned down for loans because of bad credit histories.

The specialist reviews your credit reports and listens to your goals. They identify negative items, inaccuracies, and patterns (late payments, collections, charge-offs, bankruptcies) to build a repair plan.

You sign a service agreement and often a limited power of attorney or authorization so the specialist can communicate with credit bureaus, lenders, and collection agencies on your behalf.

The specialist obtains reports from the three major bureaus (Experian, Equifax, TransUnion) and catalogs every item to dispute, prioritize, or verify—focusing on items that most impact your score.

They prepare and send formal disputes for incorrect, unverifiable, or outdated entries—using tailored dispute letters and supporting documentation to challenge each item.

The specialist follows up with credit bureaus and creditors, tracking responses, requesting reinvestigations, and escalating cases where necessary (including sending certified mail or regulatory notices).

For legitimate debts, they may negotiate with collectors for pay-for-delete agreements, settlements, or updated reporting—aiming to remove, reduce, or re-age negative marks when possible.

All correspondence, dispute results, settlement terms, and bureau responses are logged. This paper trail is essential for tracking progress and proving outcomes.

After disputes are resolved, many specialists provide ongoing monitoring, advice on rebuilding credit, and steps to prevent future problems (secured cards, credit mix, timely payments).

They teach credit-building strategies—how to use credit responsibly, lower utilization, manage installment vs. revolving debt, and when to add new credit or close accounts.

Once agreed outcomes are met or improvements occur, the specialist provides a final report, recommendations for maintaining gains, and an exit plan to sustain long-term credit health.

We credit repair specialists with over 10years experience in fixing credit of thousands of clients and with an average of 120 points improvement within a span of 6months. We know how to erase the undesired points from your credit reports and how to improve your credit score permanently.

When you choose us for credit repair services, here's what you can expect: When you choose us for credit repair services, here's what you can expect:

- Free credit analysis and game plan: First of all, everything in your reports will be reviewed and evaluated to detect potential and develop the strategy based on your needs.

- Aggressive disputes with all 3 credit bureaus: We are extremely committed to deleting unreliable, unidentified, and outdated data continually. We had developed our own unique system and that is why we have high percentage of successful outcomes.

- Ongoing optimization and guidance: It’s a good thing that we will be able to offer counseling and recommendations that can assist you to a make the right financial decisions in order to improve your credit status.

- Legal leverage when needed: If there are specific items that creditors are not willing to delete without cause, we will use the law to fight for consumers.

- 100% transparency: At every turn, we guarantee to communicate our progress to you through email, phone, and a password-protected online platform. Many times, the participants are shocked when they are charged some additional amount of money that they were not informed about in the first place.

It takes a lot of time for credit damage to begin and many opportunities can be missed in the process. Avail our services today and get the reports from all the three bureau for free analysis. We have worked with a lot of clients and our credit specialists will be able to devise a strategy for you.

Don't Close Old Accounts: The length of your credit history matters (15% of your score). Closing an old, unused credit card shortens your average account age and reduces your total available credit, which can hurt your utilization.

Apply for New Credit Sparingly: Each hard inquiry from a new application can cause a small, temporary dip in your score. Space out your credit applications and only apply for what you need.

Become a Vigilant Monitor: You are entitled to a free weekly credit report from all three bureaus at AnnualCreditReport.com. Stagger your requests throughout the year to monitor for new errors or signs of identity theft. Consider using free credit monitoring services for real-time alerts.

Create a Budget and Build an Emergency Fund: Good credit is a byproduct of overall financial health. A budget ensures you live within your means, and an emergency fund prevents you from relying on high-interest credit cards for unexpected expenses.

The cost of hiring a credit repair specialist can vary depending on the company, the level of service, and the complexity of your credit situation. On average, most credit repair companies charge between $50 and $150 per month, with many offering initial setup fees that range from $10 to $100. Some specialists may also provide pay-per-deletion services, where you only pay when a negative item is successfully removed from your credit report, usually costing between $30 and $100 per item. While hiring a professional can be an investment, many people find it worthwhile because specialists save time, handle disputes effectively, and often achieve better results than attempting the process alone. However, it’s important to choose a reputable credit repair service that complies with the Credit Repair Organizations Act (CROA) to avoid scams and unrealistic promises. Always compare fees, reviews, and service guarantees before committing.

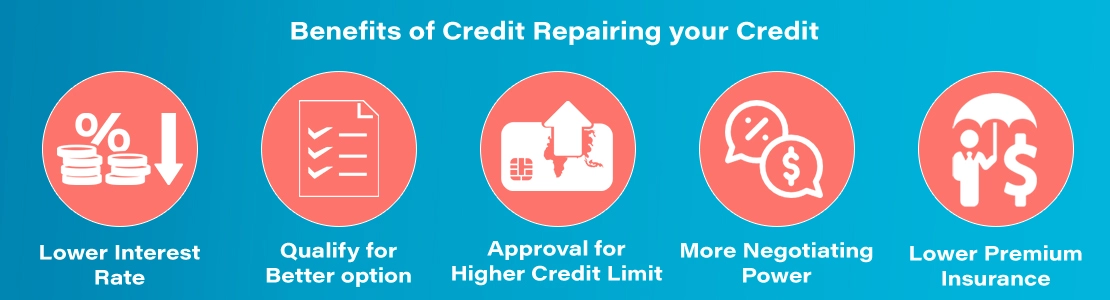

A credit repair specialist can really help you by identifying errors, inaccuracies, or outdated information on your credit reports and working directly with credit bureaus and creditors to dispute them on your behalf. They use their expertise to challenge negative items like late payments, charge-offs, collections, and even identity-related errors that might be unfairly dragging down your score. Beyond disputes, a specialist often provides personalized guidance on how to rebuild credit responsibly—such as optimizing credit utilization, managing accounts wisely, and creating a step-by-step plan tailored to your financial goals. Their experience and industry knowledge can save you time, reduce stress, and potentially raise your credit score faster than if you tried navigating the process alone. Ultimately, they act as both an advocate and advisor, helping you regain financial control and access better opportunities for loans, credit cards, and lower interest rates.

A Credit Repair Specialist is a trained professional who helps individuals improve their credit score and report by identifying and correcting errors, negotiating with creditors, and providing financial guidance.

Credit Repair Specialists review clients' credit reports, dispute inaccuracies and errors, negotiate with creditors, provide personalized financial advice, and help clients establish healthy credit habits.

It depends on the individual's specific credit situation and financial goals. However, for those struggling with a low credit score and/or inaccuracies on their credit report, a Credit Repair Specialist can provide valuable expertise and guidance in improving their financial standing.