-

Posted on: 05 Aug 2024

-

Your FICO score is a three-digit number that plays a vital role in your financial life. It's a key factor lenders use to assess your creditworthiness and determine the interest rates you'll receive on loans, credit cards, and mortgages. Understanding what lowers your FICO score is crucial for maintaining a healthy credit profile and achieving your financial goals.

The Importance of a Good FICO Score

A good FICO score unlocks numerous benefits, including:

- Lower Interest Rates: Save money on loans and credit cards.

- Easier Loan Approval: Increase your chances of getting approved for financing.

- Higher Credit Limits: Access more credit when you need it.

- Better Insurance Rates: Some insurance companies use credit scores to determine premiums.

- Rental Opportunities: Landlords often check credit scores before approving rental applications.

Conversely, a low FICO score can lead to higher interest rates, loan denials, difficulty renting an apartment, and even impact your ability to secure certain jobs.

Key Factors That Lower Your FICO Score

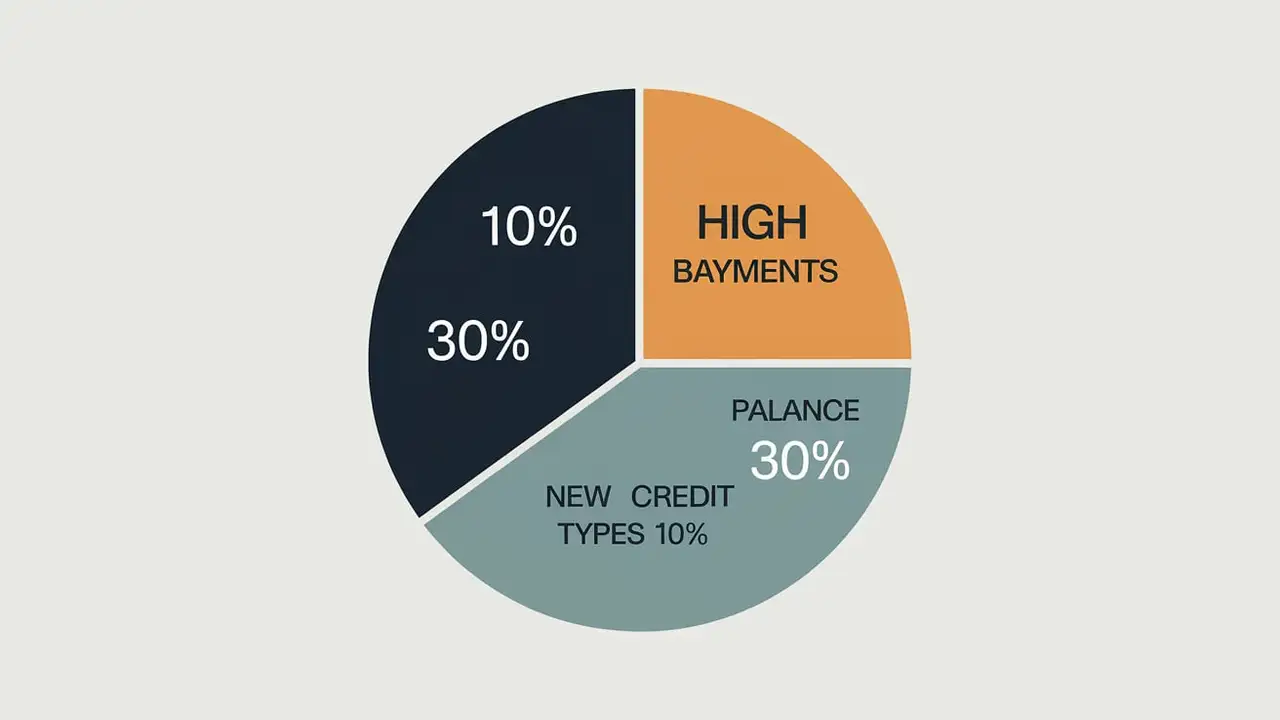

Several factors can contribute to a lower FICO score. These are generally categorized within the five major components considered by the FICO scoring model:

1. Payment History (35% of Your FICO Score)

Payment history is the single most important factor in determining your FICO score. It reflects your ability to pay your debts on time. Even a single late payment can negatively impact your score, especially if it's recent.

- Late Payments: Paying bills even a few days late can lower your score. The later the payment, the greater the negative impact.

- Collections: Accounts that are sent to collections agencies significantly damage your credit.

- Bankruptcy: Filing for bankruptcy has a severe and long-lasting negative effect on your credit score.

- Foreclosure: Losing your home to foreclosure is a major credit event that will lower your score.

- Judgments and Liens: Court judgments and tax liens can also negatively impact your credit.

2. Amounts Owed (30% of Your FICO Score)

The amount of debt you owe, and especially your credit utilization ratio, is the second most influential factor. Credit utilization is the percentage of your available credit that you are using. It's calculated by dividing your outstanding credit card balances by your total credit card limits.

- High Credit Utilization: Using a large portion of your available credit signals to lenders that you may be overextended. Aim to keep your credit utilization below 30%, and ideally below 10%. For example, if you have a credit card with a $1,000 limit, try to keep your balance below $300 (30% utilization) or even $100 (10% utilization).

- Maxed-Out Credit Cards: Maxing out your credit cards is a major red flag and will significantly lower your score.

- High Debt Levels: Carrying large balances on loans and credit cards can indicate financial strain and negatively impact your score.

3. Length of Credit History (15% of Your FICO Score)

The length of your credit history demonstrates your experience managing credit. A longer credit history generally indicates a lower risk to lenders.

- Short Credit History: If you are new to credit, your score may be lower simply because you haven't had enough time to establish a positive track record.

- Closing Old Accounts: Closing older credit accounts can shorten your credit history and potentially lower your score, especially if those accounts were in good standing. However, closing accounts with annual fees that you no longer use is sometimes a good decision. Consider the impact on your overall credit utilization and available credit before closing an account.

4. Credit Mix (10% of Your FICO Score)

Having a mix of different types of credit accounts, such as credit cards, installment loans (e.g., auto loans, student loans), and mortgages, can positively influence your score. It shows lenders that you can manage different types of debt responsibly.

- Lack of Credit Mix: Having only one type of credit account may not be as beneficial as having a diverse mix. However, avoid opening accounts just to improve your credit mix. Focus on responsible credit management.

5. New Credit (10% of Your FICO Score)

Opening multiple new credit accounts in a short period can negatively impact your score. It can signal to lenders that you are taking on too much debt too quickly.

- Too Many Credit Inquiries: Applying for multiple credit cards or loans within a short timeframe can result in multiple hard inquiries on your credit report. Too many hard inquiries can lower your score. "Rate shopping" for mortgages or auto loans within a short period (e.g., 14-45 days, depending on the scoring model) is usually treated as a single inquiry.

- Opening Too Many New Accounts: Opening several new credit accounts at once can lower your average account age and increase your overall credit utilization, both of which can negatively impact your score.

Other Factors That Can Indirectly Affect Your FICO Score

While some factors don't directly influence your FICO score, they can indirectly impact it by affecting the factors listed above.

- High Debt-to-Income Ratio (DTI): DTI is the percentage of your gross monthly income that goes towards debt payments. While not directly part of the FICO score, a high DTI can make it difficult to manage your debts and potentially lead to late payments or high credit utilization, which will lower your score.

- Unemployment or Loss of Income: Job loss or reduced income can make it challenging to pay your bills on time, leading to late payments and potentially impacting your credit utilization.

- Identity Theft: If someone steals your identity and opens fraudulent accounts in your name, it can negatively affect your credit score. Regularly monitor your credit report for suspicious activity.

How to Improve Your FICO Score

Improving your FICO score takes time and effort, but it's definitely achievable. Here are some key steps you can take:

- Pay Your Bills On Time, Every Time: This is the most important thing you can do. Set up automatic payments to avoid missing deadlines.

- Reduce Your Credit Utilization: Pay down your credit card balances to below 30%, ideally below 10%. Consider using balance transfer cards to consolidate debt.

- Check Your Credit Report Regularly: Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Dispute any errors or inaccuracies.

- Don't Close Old Credit Accounts (Unless Necessary): Closing old accounts can shorten your credit history and lower your available credit.

- Be Mindful of New Credit Applications: Avoid applying for too many credit cards or loans at once.

- Consider a Secured Credit Card: If you have a limited or damaged credit history, a secured credit card can help you build or rebuild your credit.

- Become an Authorized User: Ask a friend or family member with good credit to add you as an authorized user on their credit card. This can help you build credit history, but make sure they manage their account responsibly.

Monitoring Your Credit Score

It's essential to regularly monitor your credit score and credit report. Many services offer free credit score monitoring, which can alert you to changes in your credit profile and potential identity theft. Staying informed allows you to take proactive steps to protect and improve your credit.

Remember that building and maintaining a good FICO score is a marathon, not a sprint. Consistent responsible credit management is key to achieving your financial goals.