-

Posted on: 01 Aug 2024

-

Your credit score is a vital three-digit number that significantly impacts your financial life. It influences your ability to secure loans, rent an apartment, and even get a job. Understanding what factors contribute to a healthy credit score and actively working to improve it can unlock numerous opportunities and save you money in the long run. This comprehensive guide outlines proven strategies to increase your credit score and achieve your financial goals.

Understanding Credit Scores

Before diving into the strategies, let's understand the basics of credit scores. Credit scores are calculated based on information from your credit reports, maintained by credit bureaus such as Experian, Equifax, and TransUnion. The most widely used scoring models are FICO and VantageScore, though different lenders may use slightly different versions of these models.

What Makes Up a Credit Score?

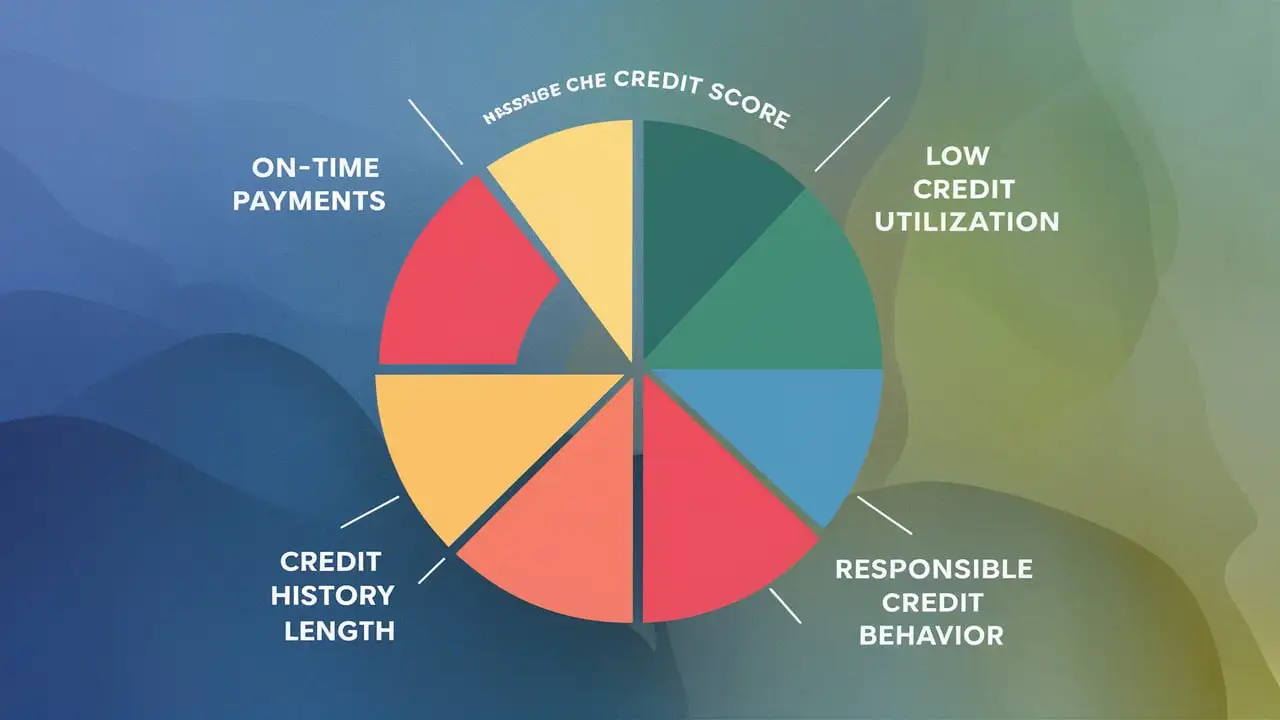

Understanding the key factors that influence your credit score is crucial for making informed financial decisions. Here's a breakdown of the major components and their relative importance:

- Payment History (35%): This is the most crucial factor. Paying your bills on time, every time, is essential. Late payments, even by a few days, can negatively impact your score.

- Amounts Owed (30%): This refers to your credit utilization ratio, which is the amount of credit you're using compared to your total available credit. Keeping your credit utilization low is key.

- Length of Credit History (15%): A longer credit history generally leads to a higher score. This is because it provides lenders with more data to assess your creditworthiness.

- Credit Mix (10%): Having a mix of different types of credit, such as credit cards, installment loans (e.g., auto loans, mortgages), and revolving credit, can positively impact your score.

- New Credit (10%): Opening too many new credit accounts in a short period can lower your score, as it can indicate higher risk.

Effective Strategies to Increase Your Credit Score

Now that you understand the factors that influence your credit score, let's explore practical strategies to improve it:

1. Make On-Time Payments, Every Time

Payment history is the single most important factor in determining your credit score. Therefore, consistently paying your bills on time is paramount. Consider setting up automatic payments for your credit cards, loans, and other bills to avoid missed payments.

Tips for Ensuring On-Time Payments:

- Set up reminders: Use your phone or calendar to remind you of upcoming due dates.

- Enroll in autopay: Automate payments from your checking account to ensure you never miss a due date.

- Consolidate bills: If possible, consolidate multiple bills into a single payment to simplify your financial management.

- Contact creditors if you're struggling: If you're facing financial difficulties, contact your creditors and explain your situation. They may be willing to work with you on a payment plan.

2. Keep Credit Utilization Low

Credit utilization refers to the percentage of your available credit that you're using. For example, if you have a credit card with a $1,000 limit and you have a balance of $300, your credit utilization is 30%. Aim to keep your credit utilization below 30%, and ideally below 10%, to maximize your credit score.

Strategies to Reduce Credit Utilization:

- Pay down your balances: The most straightforward way to lower your credit utilization is to pay down your outstanding balances.

- Request a credit limit increase: Contact your credit card issuers and request a credit limit increase. This will increase your available credit and lower your credit utilization, even if you don't spend more.

- Open a new credit card (strategically): Opening a new credit card can increase your total available credit and lower your credit utilization. However, be mindful of the "new credit" factor and avoid opening too many accounts in a short period.

3. Monitor Your Credit Report Regularly

Regularly reviewing your credit reports is essential for identifying errors and inaccuracies that could be negatively impacting your credit score. You're entitled to a free credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) once per year through AnnualCreditReport.com. You can also use free credit monitoring services offered by many financial institutions and credit card issuers.

What to Look for in Your Credit Report:

- Incorrect information: Check for errors such as misspelled names, incorrect addresses, or accounts that don't belong to you.

- Late payments: Verify that your payment history is accurate and that any late payments are correctly reported.

- Collections accounts: Review any collections accounts to ensure they are valid and accurate.

- Unauthorized accounts: Look for any accounts that you don't recognize, as this could be a sign of identity theft.

If you find any errors on your credit report, dispute them with the credit bureau that issued the report. The credit bureau is required to investigate your dispute and correct any inaccuracies.

4. Avoid Applying for Too Much Credit at Once

Each time you apply for a credit card or loan, a hard inquiry is placed on your credit report. While a single hard inquiry typically has a minimal impact, applying for multiple credit accounts in a short period can significantly lower your score, as it can indicate to lenders that you're a high-risk borrower.

Tips for Managing Credit Applications:

- Space out your applications: Avoid applying for multiple credit accounts at the same time.

- Apply for pre-approved offers: Pre-approved offers don't guarantee approval, but they indicate that you're likely to be approved for the credit account.

- Only apply for credit when you need it: Don't apply for credit just for the sake of it. Only apply when you have a specific need, such as a major purchase or debt consolidation.

5. Consider Becoming an Authorized User

If you have a friend or family member with a credit card that has a good payment history and low credit utilization, consider becoming an authorized user on their account. This can help you build credit, even if you don't have your own credit card. However, make sure that the primary cardholder is responsible and consistently makes on-time payments, as their actions will also affect your credit score.

6. Get a Secured Credit Card

If you have a limited or poor credit history, a secured credit card can be a valuable tool for building or rebuilding credit. A secured credit card requires you to deposit cash as collateral, which serves as your credit limit. By making on-time payments and keeping your credit utilization low, you can establish a positive credit history and eventually graduate to an unsecured credit card.

7. Explore Credit Builder Loans

Credit builder loans are specifically designed to help people build credit. With a credit builder loan, you make regular payments to the lender, and the lender reports your payment history to the credit bureaus. The funds from the loan are typically held in a savings account until you've completed the repayment plan, at which point you receive the funds (minus any fees or interest).

8. Diversify Your Credit Mix (Gradually)

While not as crucial as payment history or credit utilization, having a mix of different types of credit can positively impact your score. This demonstrates to lenders that you can responsibly manage various types of credit obligations. However, don't open new accounts just for the sake of diversifying your credit mix. Focus on responsibly managing the credit accounts you already have and gradually adding new types of credit as needed.

9. Be Patient and Consistent

Building or rebuilding credit takes time and consistent effort. Don't expect to see significant improvements overnight. Stick to the strategies outlined above, and be patient. Over time, your responsible financial habits will be reflected in your credit score.

Common Mistakes to Avoid

In addition to the strategies mentioned above, it's important to avoid common mistakes that can negatively impact your credit score:

- Closing old credit accounts: Closing old credit accounts, especially those with a long history, can lower your credit score by reducing your overall available credit and shortening your credit history.

- Maxing out credit cards: Maxing out your credit cards is a major red flag to lenders and can significantly lower your credit score.

- Ignoring debt: Ignoring debt and letting it go to collections will severely damage your credit score.

- Filing for bankruptcy: Bankruptcy can have a long-lasting negative impact on your credit score.