-

Posted on: 11 Aug 2023

-

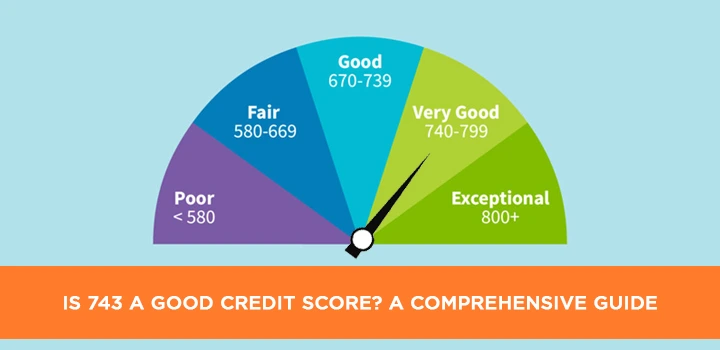

Within the field of personal finance, one's financial path is much shaped by their credit score. Among the many credit scores, a 743 has attracted a lot of interest. But just what does it mean exactly? Is 743 a credit score worth noting? This article explores the subtleties of a 743 credit score, and its ramifications and provides practical advice for either keeping or improving it.

Is 743 a Good Credit Score?

Considered usually a "Good" credit score, a credit score of 743 lies between 670 and 739. This shows good credit behavior and increases your chance of getting good loan terms and interest rates. Having a 743 credit score will help you to be sure about your financial situation and your capacity to get credit lines and loans when necessary.

The Importance of a Good Credit Score

A financial report card, your credit score shows lenders and financial organizations your creditworthiness. A strong credit score opens several financial doors:

- Lenders provide reduced interest rates to those with strong credit ratings, therefore saving you money on credit cards and loans.

- A higher credit score boosts your chances of being accepted for personal loans, vehicle loans, and mortgages.

- Good credit might provide you access to credit cards offering improved rewards, cashback, and travel benefits.

- Landlords often review credit scores when reviewing rental applications; a strong score will help your application stand out.

- Some insurance firms base prices on credit scores, hence maybe resulting in more reasonable rates.

Tips for Maintaining and Improving a 743 Credit Score

-

Timely Payments: For all of your credit responsibilities—including credit cards, loans, and utility bills—regularly pay on time. Late payments can lower your score.

-

Try to maintain your credit use percentage around thirty percent. This credit utilization ratio shows your credit use relative to your overall credit limit.

-

Having a mixed credit mix—that is, credit cards, mortgages, and installment loans—showcases good credit management.

-

Closing previous credit accounts will lower your total credit history, therefore impacting your score. Maintaining their openness, utilize them infrequently.

-

Check your credit report often for mistakes or fraudulent activity. Deal with any errors right away.

-

Applications for new credit: Reduce the number of fresh credit applications as many queries in a short time might momentarily drop your score.

-

The duration of your credit history counts. Old accounts add to your credit history hence avoid canceling them.

Conclusion

Within the field of personal finance, a 743 credit score is really impressive. From reduced interest rates to simpler loan approvals, it creates doors to improved financial options. Not only will you be able to keep decent credit score increases but also help to raise it by changing your credit practices and regularly making wise financial selections. Recall that your credit score is a reflection of your discipline and financial responsibility; it is thus a necessary instrument in your road towards financial success.

Take control of your credit today! Call (888) 803-7889 for personalized solutions.

Faq

1. What Factors Contribute to a 743 Credit Score?

A 743 credit score is influenced by factors such as payment history, credit utilization, credit mix, and the length of your credit history.

2. Can I Get a Mortgage with a 743 Credit Score?

Yes, a 743 credit score is likely to qualify you for a mortgage. However, interest rates and terms may vary based on other financial factors.

3. How Long Does It Take to Improve a Credit Score?

Improving a credit score takes time and consistent positive credit behavior. It may take several months to see significant improvements.

4. Will Closing Unused Credit Cards Help My Score?

Closing unused credit cards can potentially lower your credit score by reducing your overall available credit and shortening your credit history.

5. How Often Should I Check My Credit Score?

It's advisable to check your credit score at least once a year. Regular monitoring helps you detect and address any issues promptly.

6. Can I Get a Car Loan with a 743 Credit Score?

Yes, a 743 credit score should make you eligible for a car loan. As with mortgages, the terms you receive may vary based on other financial factors.