-

Posted on: 15 Jul 2024

-

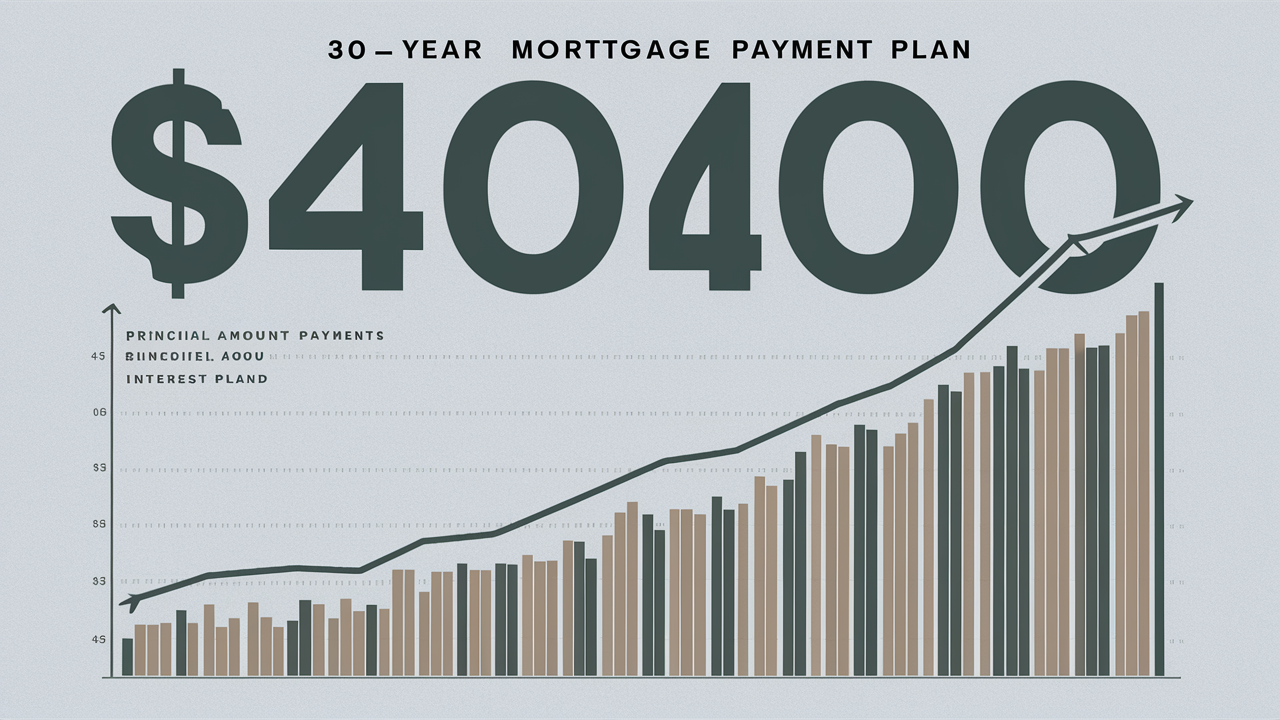

Therefore, borrowing money for thirty years is a major choice that needs careful analysis of the monthly payments. In this scenario, the amount one pays on a house loan is probably determined by the many elements like interest rate, number of years, taxes, insurance whether the borrower makes a deposit among others for a $400, 000 30-year loan. Examining each item one by one will help us to calculate the expected monthly expenses.

Interest Rates and Payment

The monthly payments to be paid depend much on the interest rate one receives when borrowing $400,000 to finance a 30-year fixed-rate mortgage. Though this changes based on your credit score, and DTI ratio, among other things, the typical 30-year mortgage rate is now in the range of 3.5 percent.

With a 3.5% interest rate, you would pay around $1,686 for the principal and interest on a loan of $400,000 per month. For every percentage point, the interest rate rises or falls, your monthly payment would alter about by $100.

Down Payment

Some of the elements influencing the monthly finance fees for the automobile include Your down payment will significantly affect the monthly payment you will be obliged to pay. Using a down payment of 20%—$80 000—the balance is $320 000, which you will be financing at a 3.5% rate for a monthly installment of $1 349.

Paying down ten percent will result in a down payment of $40,000 and a total automobile loan of $360,000. In this scenario, the principle and interest are around 3.5% hence amounts to roughly $1,525 monthly, $168 more than the 20% down payment option.

Consequently, the amount borrowed is lower and hence the mortgage payments the buyer has to pay later the more money contributed during the earlier phases as a down payment. Although saving the down payment requires a kind of discipline, owning the house will ultimately save money.

Taxes and Insurance

Apart from the principal amount and the interest, the monthly payments include property taxes, and homeowners insurance put into an escrow account. This escrow account explains how it helps pay your local annual tax and insurance policy to the insurance company.

When it comes to property taxes, count 1.25 percent of your home price per year, so $416 per month for the $400,000 home. The homeowner’s insurance may range anywhere from 0.3% to 1% yearly, thus, plan to spend somewhere between $100 to $333 monthly for the premium on a $400,000 home. Taxes plus Insurance may be as high as $450 and $800.

Altogether, you will be subjected to pay $1,950 to $2,350 per month for principal, interest, taxes, and insurance on a $ 400,000 home loan on an interest rate of 3.5% with a down payment of 20%. Paying a higher interest rate for the loan in the future can be reduced if you refinance on your mortgage. Thus getting quotes from different lenders means getting the best rates and the opportunities that meet the client’s profile when applying for such a big and long-term home loan.

Start rebuilding your credit today—contact us at (888) 803-7889 now!