-

Posted on: 23 Jul 2024

-

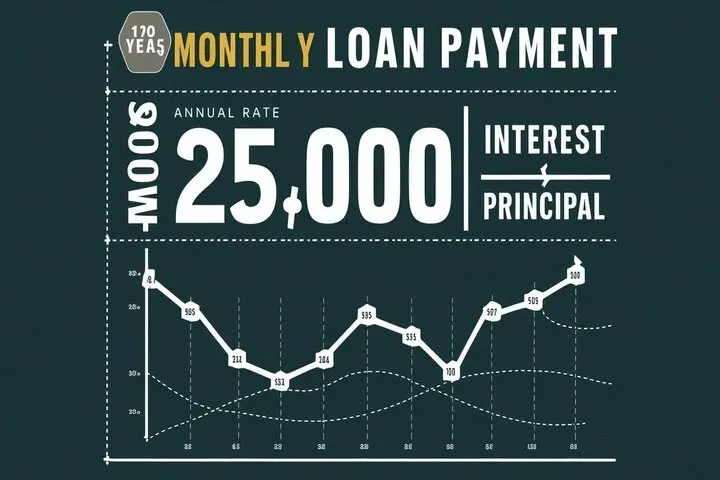

Taking out a loan is a significant financial decision. Understanding how much your monthly payments will be is crucial for budgeting and ensuring you can comfortably afford the debt. If you're considering a $25,000 loan, this guide will break down the factors influencing your monthly payments and provide insights into how to estimate them accurately.

Key Factors Affecting Your $25,000 Loan Payment

Several variables determine the size of your monthly loan payment. Understanding these factors will empower you to make informed decisions when applying for a loan.

1. Interest Rate

The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. A higher interest rate means you'll pay more in interest over the life of the loan, resulting in higher monthly payments. Interest rates are typically influenced by several things:

- Credit Score: A higher credit score generally qualifies you for lower interest rates. Lenders perceive you as a lower-risk borrower.

- Loan Type: Secured loans (like auto loans or mortgages) often have lower interest rates than unsecured loans (like personal loans) because the lender has collateral.

- Economic Conditions: Prevailing economic conditions and the Federal Reserve's monetary policy can significantly impact interest rates.

- Lender: Different lenders offer different interest rates. It's always smart to shop around and compare offers from multiple lenders.

2. Loan Term

The loan term is the length of time you have to repay the loan. A shorter loan term means higher monthly payments but lower total interest paid. A longer loan term means lower monthly payments but significantly higher total interest paid over the life of the loan.

Consider this example:

- Short Loan Term (e.g., 3 years): Higher monthly payments, lower total interest.

- Long Loan Term (e.g., 7 years): Lower monthly payments, higher total interest.

3. Loan Type

The type of loan also plays a role in determining your payment. Different loan types have different characteristics that can impact the interest rate and repayment schedule. Here are a few common loan types:

- Personal Loans: Unsecured loans typically used for various purposes, such as debt consolidation, home improvement, or unexpected expenses.

- Auto Loans: Secured loans used to purchase a vehicle. The vehicle serves as collateral for the loan.

- Student Loans: Loans specifically designed to finance education expenses.

- Small Business Loans: Loans used to start or grow a business.

Estimating Your $25,000 Loan Payment

While precise payment calculations require a loan amortization schedule, here's how to estimate your monthly payments using a loan payment formula and online calculators.

Using the Loan Payment Formula

The standard loan payment formula is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount ($25,000 in this case)

- i = Monthly Interest Rate (Annual Interest Rate / 12)

- n = Number of Months (Loan Term in Years * 12)

Let's illustrate this with an example:

Assume you have a $25,000 loan with a 6% annual interest rate and a 5-year (60-month) loan term.

- P = $25,000

- i = 6% per year / 12 months = 0.06 / 12 = 0.005

- n = 5 years * 12 months = 60

M = 25000 [ 0.005(1 + 0.005)^60 ] / [ (1 + 0.005)^60 – 1]

M ? $483.32

Therefore, the estimated monthly payment for a $25,000 loan at a 6% interest rate with a 5-year term is approximately $483.32.

Using Online Loan Calculators

Several free online loan calculators can quickly estimate your monthly payments. These calculators typically require you to input the loan amount, interest rate, and loan term. They'll automatically calculate your monthly payment and often display an amortization schedule showing how much of each payment goes toward principal and interest.

Some popular online loan calculators include:

- Bankrate Loan Calculator

- NerdWallet Loan Calculator

- Calculator.net Loan Calculator

Simply search for "[loan payment calculator]" on your favorite search engine to find a plethora of options.

Simple Loan Calculator

Use this simple form to estimate your monthly payments. (Please note: This is a placeholder and does not perform actual calculations.)

Impact of Different Interest Rates and Loan Terms

Let's examine how different interest rates and loan terms affect your $25,000 loan payment.

Scenario 1: Impact of Interest Rate (5-Year Loan Term)

- Interest Rate: 4% - Estimated Monthly Payment: $460.42

- Interest Rate: 6% - Estimated Monthly Payment: $483.32

- Interest Rate: 8% - Estimated Monthly Payment: $506.62

As you can see, a 2% increase in the interest rate results in a significant increase in your monthly payment. Aim to secure the lowest possible interest rate by improving your credit score and shopping around for the best offers.

Scenario 2: Impact of Loan Term (6% Interest Rate)

- Loan Term: 3 Years (36 Months) - Estimated Monthly Payment: $760.58

- Loan Term: 5 Years (60 Months) - Estimated Monthly Payment: $483.32

- Loan Term: 7 Years (84 Months) - Estimated Monthly Payment: $362.18

Extending the loan term significantly reduces your monthly payment, but you'll pay considerably more interest over the life of the loan. Choose a loan term that balances affordability with the total cost of borrowing.

Strategies for Securing a Lower Loan Payment

Here are some strategies to consider to potentially lower your loan payments:

- Improve Your Credit Score: A higher credit score can unlock lower interest rates. Review your credit report, dispute any errors, and focus on paying bills on time.

- Shop Around for the Best Rates: Don't settle for the first loan offer you receive. Compare rates and terms from multiple lenders, including banks, credit unions, and online lenders.

- Consider a Co-signer: If you have a limited credit history or a low credit score, adding a co-signer with good credit can improve your chances of approval and potentially lower your interest rate.

- Increase Your Down Payment (if applicable): If you're taking out a loan for a car or a house, a larger down payment reduces the loan amount you need to borrow, resulting in lower monthly payments.

- Negotiate with the Lender: Don't be afraid to negotiate with the lender, especially if you have a strong credit history or a long-standing relationship with the financial institution.

Understanding Loan Amortization

Loan amortization is the process of gradually paying off a loan over time through regular payments. Each payment consists of both principal and interest. In the early stages of the loan, a larger portion of your payment goes toward interest, while in the later stages, a larger portion goes toward the principal.

An amortization schedule is a table that shows how each payment is allocated between principal and interest. It also tracks the remaining loan balance after each payment. Reviewing your loan's amortization schedule can provide valuable insights into how your loan is being repaid and the total amount of interest you'll pay over the loan term.

Most online loan calculators will provide an amortization schedule along with the payment calculation.

The Importance of Budgeting

Before taking out a $25,000 loan, it's crucial to assess your financial situation and create a budget. Ensure that you can comfortably afford the monthly payments without straining your finances.

Consider the following when budgeting:

- Income: Calculate your monthly income after taxes.

- Expenses: Track your monthly expenses, including housing, transportation, food, utilities, and other debts.

- Debt-to-Income Ratio (DTI): Calculate your DTI, which is the percentage of your gross monthly income that goes toward debt payments. A lower DTI indicates a healthier financial situation.

- Savings: Set aside a portion of your income for savings and emergencies.

If your expenses exceed your income or your DTI is too high, reconsider taking out the loan or explore ways to reduce your expenses.