-

Posted on: 22 Jul 2024

-

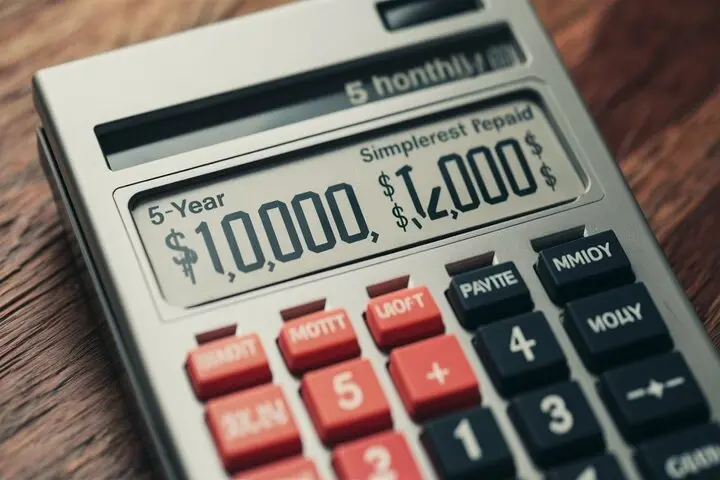

Taking out a loan can be a significant financial decision. Whether it's for consolidating debt, funding a home improvement project, or covering unexpected expenses, understanding the total cost of a loan is crucial. This article will explore the true cost of a $10,000 loan with a repayment period of 5 years (60 months). We'll delve into the factors that influence your monthly payments and the overall amount you'll end up paying, including interest rates, fees, and different loan types. By the end of this guide, you'll have a clear understanding of what to expect and how to make informed decisions about borrowing money.

Breaking Down the $10,000 Loan: Key Factors

Several elements determine the total cost of a $10,000 loan. Let's examine the most important:

- Principal Amount: This is the initial amount borrowed, in this case, $10,000.

- Interest Rate: The percentage charged by the lender for borrowing the money. This is usually expressed as an Annual Percentage Rate (APR). The higher the APR, the more you'll pay in interest over the life of the loan.

- Loan Term: The length of time you have to repay the loan. In this scenario, it's 5 years (60 months). A longer term means lower monthly payments, but you'll pay more in interest overall. A shorter term means higher monthly payments, but less total interest paid.

- Fees: Some lenders charge origination fees, application fees, or prepayment penalties. These fees can significantly impact the overall cost of the loan. Always read the fine print and understand all applicable fees.

Understanding Interest Rates

The interest rate is perhaps the most significant factor influencing the total cost of your loan. Interest rates can be fixed or variable. A fixed interest rate remains the same throughout the loan term, providing predictable monthly payments. A variable interest rate can fluctuate based on market conditions, potentially leading to unpredictable monthly payments. Variable rates can sometimes start lower than fixed rates, but they carry the risk of increasing over time.

Your credit score plays a crucial role in determining the interest rate you'll receive. Borrowers with excellent credit scores typically qualify for the lowest interest rates, while those with lower credit scores may face higher rates.

Here's a simplified table illustrating how different interest rates can affect the monthly payment and total cost of a $10,000 loan over 5 years:

Interest Rate (APR) Estimated Monthly Payment Total Amount Paid (Principal + Interest) Total Interest Paid 5% $188.71 $11,322.74 $1,322.74 8% $202.76 $12,165.64 $2,165.64 12% $222.44 $13,346.52 $3,346.52 15% $237.90 $14,274.00 $4,274.00 Disclaimer: These are estimated figures. Use a loan calculator for more precise calculations, as results may vary slightly depending on the lender and specific loan terms.

Loan Amortization: How Your Payments are Allocated

Loan amortization is the process of paying off a loan over time with regular payments. Each payment you make covers both the principal amount and the accrued interest. Initially, a larger portion of your payment goes towards interest, and as you continue to make payments, a larger portion goes towards the principal.

Understanding the amortization schedule is beneficial because it allows you to see exactly how much of each payment is going towards the principal and interest. This information can be helpful if you plan to pay off the loan early.

Many online loan calculators provide an amortization schedule, allowing you to see the breakdown of each payment.

Types of Loans to Consider

Several types of loans can be used for a $10,000 borrowing need. Each type has its own advantages and disadvantages:

- Personal Loans: These are unsecured loans (meaning they don't require collateral) that can be used for various purposes. Interest rates on personal loans are typically higher than secured loans.

- Secured Loans: These loans require collateral, such as a car or a home. Because they are secured, they often come with lower interest rates. However, you risk losing your collateral if you fail to repay the loan.

- Credit Card Cash Advances: While convenient, cash advances typically have very high interest rates and fees. They should be avoided unless absolutely necessary.

- Home Equity Loans (HELOCs): If you own a home, you might consider a home equity loan or a home equity line of credit (HELOC). These loans use your home equity as collateral and usually offer lower interest rates than personal loans. However, you risk foreclosure if you can't repay the loan.

- Loans from Family and Friends: Borrowing from loved ones can be an option, but it's essential to establish clear terms and conditions to avoid damaging relationships.

Personal Loans in Detail

Personal loans are a popular choice for many borrowers needing $10,000. They offer a fixed repayment schedule and can be used for various purposes. However, interest rates can vary significantly depending on your credit score and the lender.

Pros of Personal Loans:

- No collateral required

- Fixed repayment schedule

- Funds can be used for various purposes

Cons of Personal Loans:

- Interest rates can be higher than secured loans

- May require a good credit score

- Origination fees may apply

Secured Loans: Using Assets as Collateral

Secured loans, such as auto loans or home equity loans, use an asset as collateral. This reduces the risk for the lender, often resulting in lower interest rates. However, if you fail to repay the loan, the lender can seize the collateral.

Pros of Secured Loans:

- Lower interest rates

- May be easier to qualify for with a lower credit score

Cons of Secured Loans:

- Requires collateral

- Risk of losing collateral if you fail to repay the loan

- May require an appraisal or other fees

Calculating Your Loan Payments: Online Loan Calculators

The easiest way to determine the monthly payments and total cost of a $10,000 loan is to use an online loan calculator. These calculators allow you to input the principal amount, interest rate, and loan term to calculate your monthly payments and total interest paid.

Many free online loan calculators are available. Simply search for "loan calculator" on Google or another search engine. Be sure to use a reputable calculator and double-check the results.

Example Calculation Using an Online Loan Calculator

Let's say you find a personal loan with a $10,000 principal, an interest rate of 8%, and a loan term of 5 years (60 months). Using an online loan calculator, you would input these values, and the calculator would provide the following results:

- Monthly Payment: $202.76

- Total Amount Paid: $12,165.64

- Total Interest Paid: $2,165.64

This means that over the 5-year loan term, you would pay a total of $12,165.64, including the $10,000 principal and $2,165.64 in interest.

Tips for Getting the Best Loan Terms

Getting the best loan terms can save you a significant amount of money over the life of the loan. Here are some tips to help you secure the most favorable terms:

- Improve Your Credit Score: A higher credit score will qualify you for lower interest rates. Check your credit report for errors and take steps to improve your score, such as paying bills on time and reducing your credit utilization ratio.

- Shop Around: Don't settle for the first loan offer you receive. Compare offers from multiple lenders, including banks, credit unions, and online lenders.

- Negotiate: Don't be afraid to negotiate with lenders to see if they can offer you a better interest rate or lower fees.

- Consider a Co-signer: If you have a low credit score, a co-signer with good credit can help you qualify for a loan and potentially get a lower interest rate.

- Read the Fine Print: Carefully review all loan documents before signing. Make sure you understand the interest rate, fees, repayment terms, and any other conditions.

- Minimize Your Debt-to-Income Ratio: Lenders consider your debt-to-income ratio (DTI) when assessing your loan application. A lower DTI demonstrates that you have more disposable income to repay the loan.

The Impact of Loan Term on Total Cost

The length of your loan term significantly affects both your monthly payment and the total interest you pay. A longer loan term will result in lower monthly payments, making the loan more manageable in the short term. However, you will pay significantly more in interest over the life of the loan.

Conversely, a shorter loan term will result in higher monthly payments, but you will pay less in total interest. If you can afford the higher monthly payments, a shorter loan term is generally the better option because you will save money in the long run.

Consider these scenarios for a $10,000 loan at 8% interest:

- 3-Year Loan (36 Months): Monthly Payment ? $313.36, Total Interest ? $1,281.08, Total Paid ? $11,281.08

- 5-Year Loan (60 Months): Monthly Payment ? $202.76, Total Interest ? $2,165.64, Total Paid ? $12,165.64

- 7-Year Loan (84 Months): Monthly Payment ? $155.08, Total Interest ? $3,026.55, Total Paid ? $13,026.55

As you can see, extending the loan term from 3 years to 7 years significantly increases the total interest paid, even though the monthly payments decrease.

Budgeting and Affordability

Before taking out a $10,000 loan, it's essential to assess your budget and ensure that you can comfortably afford the monthly payments. Consider your income, expenses, and existing debts. Create a budget to determine how much you can realistically allocate to loan repayment each month.

If you're struggling to make ends meet, taking out a loan may not be the best option. Consider exploring alternative solutions, such as reducing your expenses, increasing your income, or seeking financial counseling.

Remember to factor in potential unexpected expenses when assessing your affordability. A job loss, medical emergency, or other unforeseen event could make it difficult to repay the loan.