-

Posted on: 05 Aug 2024

-

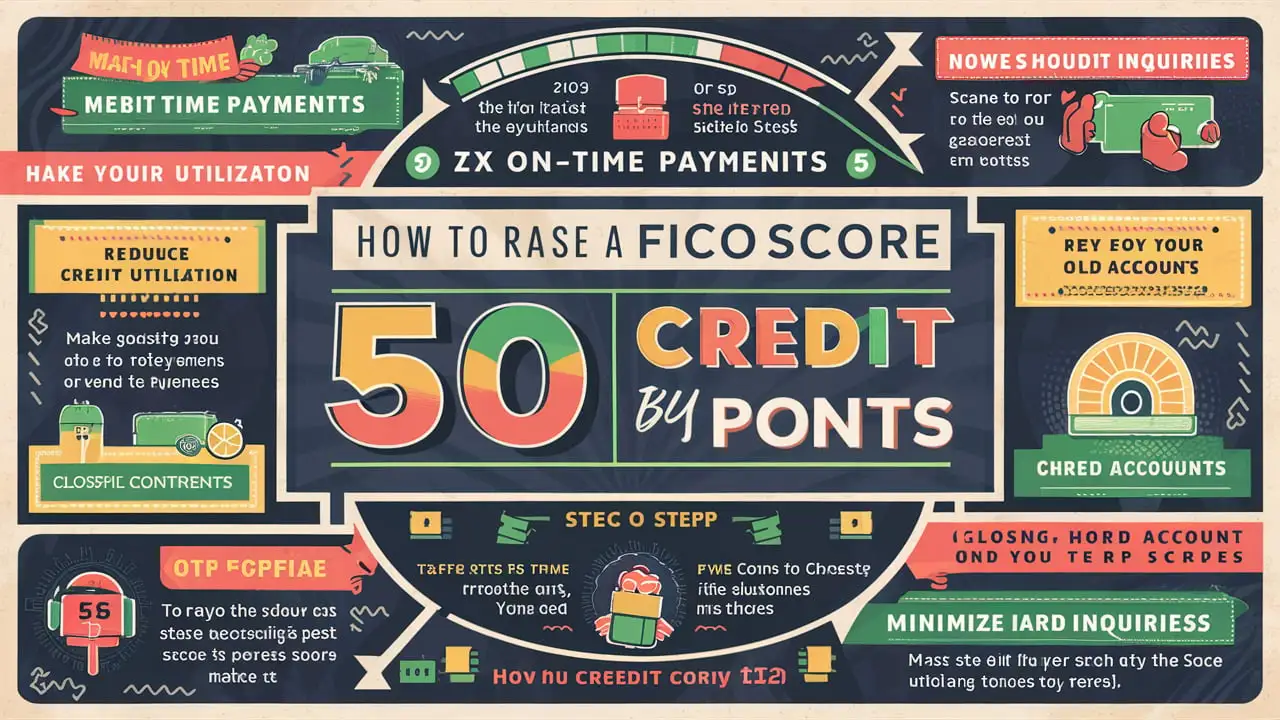

Your FICO score is a crucial three-digit number that lenders use to assess your creditworthiness. A higher score can unlock better interest rates on loans, credit cards, and mortgages, saving you thousands of dollars over time. If you're looking to improve your financial standing, raising your FICO score by 50 points is an achievable goal with the right strategies and consistent effort. This guide provides a comprehensive roadmap to help you achieve that.

Understanding Your FICO Score

Before diving into the strategies, it's important to understand the key factors that contribute to your FICO score. FICO scores are calculated based on five main categories:

- Payment History (35%): This is the most significant factor. Making on-time payments is crucial.

- Amounts Owed (30%): This refers to the amount of debt you have compared to your credit limits, also known as credit utilization.

- Length of Credit History (15%): A longer credit history generally contributes to a higher score.

- Credit Mix (10%): Having a mix of credit accounts (e.g., credit cards, installment loans) can be beneficial.

- New Credit (10%): Opening too many new accounts in a short period can negatively impact your score.

Understanding how these factors influence your score is the first step towards improving it.

Step-by-Step Strategies to Boost Your FICO Score

1. Review Your Credit Report for Errors

The first crucial step is to obtain a copy of your credit report from all three major credit bureaus: Experian, Equifax, and TransUnion. You can get a free copy of your credit report annually from AnnualCreditReport.com.

Carefully review each report for any inaccuracies, such as:

- Incorrect account information (e.g., closed accounts listed as open)

- Late payments incorrectly reported

- Accounts that don't belong to you (potentially indicating identity theft)

- Duplicate accounts

If you find any errors, dispute them with the credit bureau. The credit bureau is required to investigate and correct any inaccuracies within 30 days.

How to Dispute Credit Report Errors

Each credit bureau has a process for disputing errors. Typically, you can file a dispute online or by mail. Be sure to provide detailed information about the error and any supporting documentation you have.

Here are the links to the dispute pages for each major credit bureau:

- Experian: Experian Dispute Center

- Equifax: Equifax Dispute Center

- TransUnion: TransUnion Dispute Center

2. Improve Your Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you're using compared to your total available credit. It's calculated by dividing your outstanding balance by your credit limit. For example, if you have a credit card with a $1,000 limit and a balance of $300, your credit utilization is 30%.

Lenders generally prefer a low credit utilization ratio, ideally below 30%. The lower the better, with some sources suggesting aiming for under 10% to really maximize its impact on your credit score.

Strategies to Lower Your Credit Utilization Ratio

- Pay down your credit card balances: This is the most direct way to lower your utilization. Focus on paying off the cards with the highest balances first.

- Ask for a credit limit increase: Contact your credit card issuers and request a higher credit limit. A higher limit will automatically lower your utilization ratio, even if your spending remains the same. Be careful not to overspend!

- Open a new credit card: Opening a new credit card will increase your overall available credit, which can lower your utilization ratio. However, be mindful of the potential impact on your new credit score factor. Only consider this if you can responsibly manage the new account.

- Time your payments: Some credit card companies report your balance to the credit bureaus at the end of the billing cycle. If possible, make a payment before the end of the billing cycle to lower the reported balance.

3. Make On-Time Payments Consistently

Payment history is the most important factor in determining your FICO score. Even one late payment can negatively impact your score, especially if you have a limited credit history.

Tips for Making On-Time Payments

- Set up automatic payments: Automate your payments to ensure you never miss a due date. You can typically set this up through your bank or the credit card issuer's website.

- Use calendar reminders: Set reminders on your phone or calendar to remind you when payments are due.

- Pay more than the minimum: Paying more than the minimum payment each month will not only help you pay off your debt faster but also demonstrate responsible credit management.

- Contact lenders immediately if you're facing financial difficulties: If you're struggling to make payments, contact your lenders to discuss potential options, such as a payment plan or hardship program.

4. Avoid Opening Too Many New Accounts

Opening too many new credit accounts in a short period can lower your average account age and increase the number of inquiries on your credit report, both of which can negatively impact your FICO score.

Avoid opening multiple new accounts unless absolutely necessary. If you're planning to apply for several loans or credit cards, space out your applications over several months.

5. Keep Old Accounts Open (Even if You Don't Use Them)

The length of your credit history is a factor in your FICO score. Closing old accounts can shorten your credit history and potentially lower your score. If you have old credit cards that you no longer use, consider keeping them open (as long as there are no annual fees and you can manage them responsibly). Even if you don't use them, they contribute to your overall credit limit and length of credit history.

To keep the accounts active, consider using them for a small purchase every few months and then paying off the balance immediately.

6. Consider Becoming an Authorized User

If you have a friend or family member with a credit card account in good standing (i.e., a long credit history, on-time payments, and low credit utilization), ask if they would be willing to add you as an authorized user. The account's payment history and credit utilization will then be reported to your credit report, which can help improve your score. However, this strategy is only effective if the primary account holder manages the account responsibly.

Note: Some credit card issuers don't report authorized user accounts to all three credit bureaus, so be sure to check with the issuer before becoming an authorized user.

7. Explore Credit Builder Loans

Credit builder loans are designed to help individuals with limited or no credit history establish a positive payment history. With a credit builder loan, you make fixed monthly payments over a set period of time, and the lender reports your payment activity to the credit bureaus. The loan proceeds are typically held in a savings account until the loan is repaid.

Credit builder loans can be a good option if you're starting to build your credit from scratch.

8. Consider a Secured Credit Card

A secured credit card requires you to make a cash deposit that serves as your credit limit. Secured credit cards are often easier to obtain than unsecured cards, especially if you have a limited or poor credit history. By using the secured card responsibly and making on-time payments, you can gradually build your credit score.

9. Negotiate with Creditors

If you have past-due accounts that are negatively impacting your credit score, try negotiating with the creditors. You might be able to negotiate a settlement agreement where you pay a portion of the debt in exchange for the creditor removing the negative information from your credit report. However, be aware that not all creditors are willing to negotiate, and even if they are, they might not agree to remove the negative information.

10. Be Patient and Persistent

Improving your FICO score takes time and consistent effort. Don't expect to see results overnight. Continue to follow these strategies diligently, and you should start to see improvements in your score over time. It's important to monitor your credit report regularly to track your progress and ensure that your efforts are paying off.

Things That Won't Improve Your FICO Score

It's also important to know what *won't* help your FICO score:

- Paying off closed accounts in full (if the negative information is already on your report): Once a late payment or other negative event is reported, simply paying it off won't erase the past. While it's always good to resolve outstanding debts, it won't magically remove the negative mark.

- Using debit cards: Debit card usage doesn't contribute to your credit score because it's not a line of credit.

- Checking your own credit report too often: Checking your own credit report is a "soft inquiry" and doesn't impact your score. The only thing that *could* happen, if you're checking it through a service that offers credit monitoring and requires you to authorize access to your account information, is that the *application* for the service could trigger a hard inquiry (but this is rare and usually disclosed).