-

Posted on: 09 Feb 2023

-

Does your credit score worry you? Do you want to get your financial situation back under control? If so, you should find this blog article perfect. To help you decide which credit repair business is best for you, we have listed the top 2023 credit repair firms and a side-by-side comparison of them. Read on to learn more!

Introduction to Credit Repair

Good credit is very vital in daily life. Better housing, better employment, and even reduced loan or credit card interest rates may all be accessed via this portal. But supposing your credit score falls short of what you would want it to be? Should such be the case, this blog article is meant for you. We will go over the basics of credit repair and how it may aid in raising your financial situation in this piece.

The Top Credit Repair Companies of 2023

1. CreditRepair.com:

Comprising excellent services for customers looking to raise their credit scores and histories,CreditRepair.com is a complete credit repair organization. They provide customized solutions including dispute resolution, counseling services, account monitoring, and report writing to enable people to address their credit problems.

Review: CreditRepair.com

2. Credit Repair Ease:

Personalized strategies to assist people raise their scores, dispute resolution for erroneous or unverifiable information on reports, counseling services, and more are just a few of the credit repair options Credit Repair Ease offers. They are renowned for offering their customers results-oriented solutions in addition to high-quality customer service.

3. Lexington Law:

Founded in 1991, Lexington Law is among the biggest and most respectable credit repair firms now on the scene. Their offerings include frequent account and report monitoring for changes, dispute resolution for erroneous or unverifiable information on reports, and customized programs that fit particular requirements.

Read More: Lexington Law Review, Lexington Law Pricing

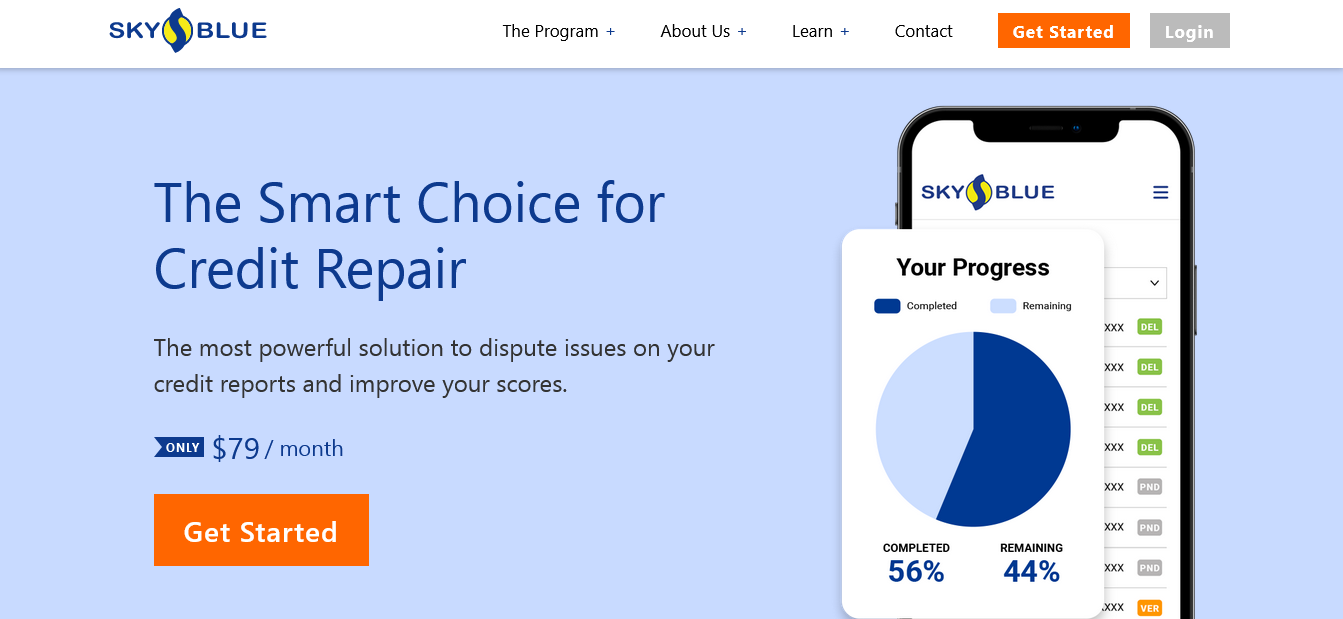

4. Sky Blue Credit Repair:

Reputable and trustworthy credit restoration firm Sky Blue Credit Repair provides complete services including dispute resolution, tailored programs, credit counseling, and more. Having decades of industry knowledge, they have guided many clients in effectively enhancing their credit records and backgrounds.

5. The Credit Pros:

Experienced credit repair firm The Credit Pros offers a broad spectrum of services including bespoke programs catered to particular requirements, dispute resolution for erroneous or unverifiable data on reports, counseling services, and much more. Their staff is very skilled in guiding customers toward their intended financial objectives and in strengthening their general financial situation.

Review of the Top Credit Repair Companies

Using the top credit repair firms can help you take charge of your money and raise your credit score. To identify the best ways to clear bad things from your credit report, improve your credit score, and get you back on track financially, we have looked at hundreds of businesses.

We can assist you in locating a reputable credit repair company capable of creating customized solutions within your budget and requirements. Our knowledgeable staff will go over your circumstances, find any mistakes on your credit report, and assist you in disputing any erroneous information. We will also arrange debt settles or payment schedules with creditors.

You may begin laying a brighter financial future right now with our guidance!

Pros and Cons of each Company

More and more individuals are seeking solutions to raise their credit scores, hence credit repair firms have grown in popularity. These firms may help you negotiate with creditors, contest mistakes on your credit record, and raise your credit score generally.

Before agreeing to any credit repair program, however, it's wise to consider the advantages and drawbacks. High prices and promises they cannot follow are hallmarks of credit repair organizations. Furthermore important is the knowledge that only you can establish and keep a high credit score; credit repair firms cannot help you in this regard.

Cost Comparison of Credit Repair Companies

Provider-to-provider differences in credit repair company costs reflect the services needed. For basic services like monitoring and dispute resolution, consumers should generally budget between $50 and $200 each month. More thorough services might call for an upfront setup cost or extra monthly payments for more focused help.

Certain credit repair firms, for instance, provide one-time flat-fee packages including a comprehensive credit history assessment combined with individualized help to find and challenge mistakes. In the end, the particular demands and budget of the client define the cost of credit repair services.

Summary of Findings and Recommendations

Studies on credit repair firms have given a whole picture of the services they provide and how they may assist individuals in raising their credit ratings. Credit repair firms should concentrate on giving their customers clear, intelligible information, and advice. They should also be open about their charges, offerings of services, and anticipated outcomes of their work.

Moreover, businesses should provide tools such as instructional materials and financial position analysis advice to enable customers to make wise judgments and grasp their circumstances. Furthermore, by offering outstanding customer service, credit repair firms should aim to establish close bonds with their consumers.

To keep compliance with relevant rules and regulations, they must also constantly evaluate their activities and change as necessary.

Conclusion:

Finally, the best credit repair firms of 2023 have all shown their capacity to provide dependable and efficient services. Lexington Law is well-known for its vast area of expertise and its handling of the rules of credit repair. With its cheap monthly price, dedication to customer care, and a money-back guarantee, Credit Repair Ease has risen to leadership in the sector. CreditRepair.com has developed a name for providing a user-friendly interface that lets consumers rapidly check their credit records and find areas needing work. Ultimately, The Credit Pros Credit Services offers innovative technologies and tailored services from a team of professionals to assist in simplifying the process of raising credit scores.

Every one of these businesses provides unique qualities and services that distinguish them in the credit repair industry.

Need better credit? Call (888) 803-7889 and let the experts help you!